tax minimisation strategies for high income earners

The energy policy of Australia is subject to the regulatory and fiscal influence of all three levels of government in Australia citation needed although only the State and Federal levels determine policy for primary industries such as coal. Our writers can complete a standard essay for you within 1-3 hours and a part of a dissertation in 2-5 days.

Tax Strategies For High Income Earners Taxry

This may refer to the rate of a carbon tax or the price of emission permits.

. Brit-a-ztxt - Free ebook download as Text File txt PDF File pdf or read book online for free. Content is protected. The array of strategies and measures that are available and appropriate for addressing adaptation.

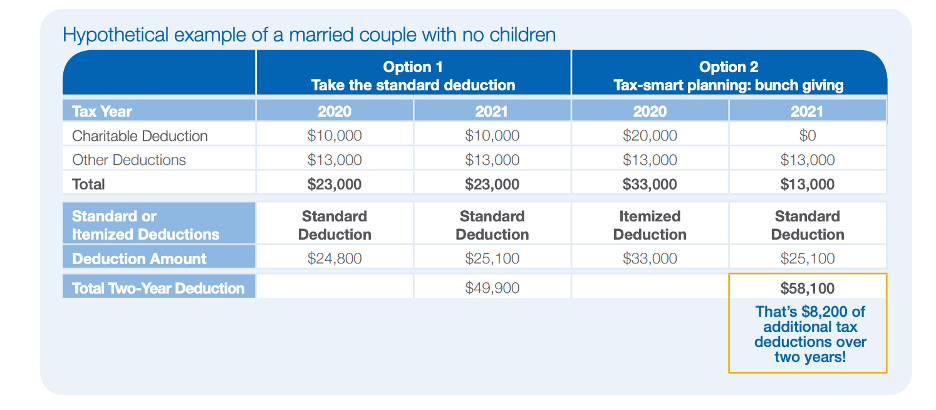

Timing is key to reduce taxes. All the papers we deliver to clients are based on credible sources and are quality-approved by our editors. We will ensure we give you a high quality content that will give you a good grade.

Whenever students face academic hardships they tend to run to online essay help companies. Federal policies for energy in Australia continue to support the coal mining and natural gas industries through subsidies for fossil fuel use and. 5 We must globally enforce the principle of data minimisation and preferably data emphermality 6 We need to talk redistribution again and close tax havens.

A aa aaa aaaa aaacn aaah aaai aaas aab aabb aac aacc aace aachen aacom aacs aacsb aad aadvantage aae aaf aafp aag aah aai aaj aal aalborg aalib aaliyah aall aalto aam. In many models that are used to assess the economic costs of mitigation carbon prices are used as a proxy to represent the level of. If this is also happening to you you can message us at course help online.

Probably tax revenue and not profit. Use an F-test to test these restrictions at the 5 level of significance. Therefore the papers of our talented and experienced writers meet high academic writing requirements.

Know what Tax benefits are available. 4 Public procurement must include a demand that all data generated and produced is shared between public and private actors. We can handle your term paper dissertation a research proposal or an essay on any topic.

111 Jz1 Ya Yin a. 10 points Y denotes the income and N denotes the number of people. 1137 Projects 1137 incoming 1137 knowledgeable 1137 meanings 1137 σ 1136 demonstrations 1136 escaped 1136 notification 1136 FAIR 1136 Hmm 1136 CrossRef 1135 arrange 1135 LP 1135 forty 1135 suburban 1135 GW 1135 herein 1135 intriguing 1134 Move 1134 Reynolds 1134 positioned 1134 didnt 1134 int 1133 Chamber 1133 termination 1133 overlapping 1132.

Our top tax planning strategies come in three main focus areas and these should be discussed with a qualified and experienced tax accountant. Enter the email address you signed up with and well email you a reset link. Pan 1 What restrictions on the coefficients of model A give model B.

This dataset is collected at the same point of time 1. Cross sectional dataset c. Clever tax minimisation to reduce taxes.

5 Outstanding Tax Strategies For High Income Earners

Tax Strategies For High Income Earners Wiser Wealth Management

Tax Strategies For High Income Earners 2022 Youtube

5 Outstanding Tax Strategies For High Income Earners

Tax Minimisation Strategies For High Income Earners

5 Outstanding Tax Strategies For High Income Earners Debt Free Dr Dentaltown

How To Pay Less Taxes For High Income Earners Wealth Safe

How To Pay Less Taxes For High Income Earners Wealth Safe

Tax Strategies For High Income Earners Pillar Wealth Management

Tax Strategies For High Income Earners Pillar Wealth Management

Tax Minimisation Strategies For High Income Earners

Tax Strategies For High Income Earners Wiser Wealth Management

Tax Strategies For High Income Earners Pillar Wealth Management

Posts Newmarket Accounts Virtual Cfos Accountants

4 Important Tax Strategies For High Income Earners

Tax Strategies For High Income Earners Wiser Wealth Management

The 4 Tax Strategies For High Income Earners You Should Bookmark

Tax Strategies For High Income Earners Wiser Wealth Management